Our Mission

To provide sustainable economic and fiscal policies: high quality programs and activities to accompany a prudent regulatory framework that supports a vibrant, resilient economy which offers opportunities for the improvement of the standard of living and well-being of the citizens of St. Kitts and Nevis.

Our Vision

The Ministry’s vision is to enhance confidence in the economy of St. Kitts and Nevis by creating a sound and sustainable fiscal environment. The Ministry considers responsible fiscal policy as one of its main objectives since responsible fiscal policies secure the resources necessary to maintain and enhance the delivery of key public services and also strengthens the Ministry’s goals to ensure that the costs of public services are not passed on unjustly to future generations. Public confidence is further strengthened by the demonstration of appropriate management of government finances. The Ministry places critical emphasis on improving the competitiveness of St. Kitts and Nevis in order to create the enabling environment for sustained growth and development to take place.

Strategic Direction

According to the Saint Christopher and Nevis (Mutual Exchange of Information on Taxation Matters) Act, 2009, the Financial Secretary is the Tax Co-operation Authority (Competent Authority) for the purpose of exchange of information on taxation matters between the Federation of St. Christopher (St. Kitts) and Nevis and other jurisdictions. The Competent Authority is responsible for:

i. Executing requests for information for tax purposes;

ii. Ensuring compliance with TIEAs and DTCs

iii. Advising the Minister of Finance on matters relating to any proposals or agreements for the provision of information in tax matters; and

iv. Making determinations as to any costs and the apportionment of such costs relating to or arising from requests for information.

Annual Objectives

- To strengthen Public Financial Management

- To reduce Public Sector debt to a sustainable level

- To strengthen the management of Government’s debt

- To establish conditions for sustained economic growth

- To ensure compliance with international standards on tax transparency and exchange of information

- To achieve a Primary Balance Surplus of 0.8% of GDP

- To improve the medium-term orientation of the budget

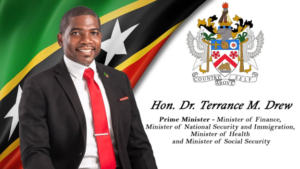

Prime Minister’s Message

In 2023, the Government of St. Kitts and Nevis commenced the engagement with key stakeholders in the community to garner support and input that will translate the Sustainable Island State Agenda into tangible outputs. Global recovery post-COVID continues to be sluggish due to the long-term consequences of the pandemic, growing geopolitical conflict, geoeconomics fragmentation, tightening of monetary policy to address inflation, the conclusion of fiscal support and extreme weather. These international conditions have the potential to affect our internal efforts to stimulate equitable growth and development. As a result, sustainable fiscal and debt management remains the cornerstone to our Sustainable Island State Agenda as this will provide us with the necessary financial capacity to make our vision a reality. The 2024 Estimates have been compiled with the recognition that as we move towards a more resilient State, it is necessary for us to maintain adequate fiscal buffers to enhance our responsiveness to exogenous shocks which remain a threat to our sustainability as a Small Island Developing State (SIDS).

The Ministry of Finance has continued to lead by providing critical fiscal and debt advice to ensure that the Government’s performance in both respects remain on a positive trajectory. To this end, the Ministry continues to produce the Medium-term Fiscal Framework (MTFF) which provides the guidance which is critical in the decision-making process to support the 2024 plans and priorities. The Government has benefited tremendously from strong fiscal and debt management which translate into sustainable lives and livelihoods for our citizens and residents.

The Ministry continues to carefully assess the global economic conditions. The World Economic Outlook, issued by the International Monetary Fund in October 2023, projected that the global economy will expand by 3.0% in 2023 and 2.9% in 2024. An assessment of the national economy predicts a growth rate of 3.9% by the end of 2023 with continued expansion in economic activity of 3.6% in 2024. Economic performance in 2024 is expected to be stimulated by continued positive growth from critical sectors such as, Agriculture, Manufacturing, Construction, Wholesale and Retail Trade; Hotels and Restaurants; Transport, Storage and Communications; Financial Services and Public Administration. Over the medium-term the economy will expand by an average of 3.4%. An assessment of the Revenue and Expenditure plans proposed for 2024 reveal a Recurrent Account Surplus of $200.2 million, an Overall Surplus of $24.6 million and a Primary Surplus of $41.1 million. The Government is cognizant of the need to address downside risks that can undermine our debt and fiscal sustainability. As a result, we will continue to assess fiscal structural measures that can redound to improved fiscal and debt outcomes.

At the end of September 2023, the Total Public Sector Debt of St. Kitts and Nevis was $1,585.7 million. Compared to the corresponding period in 2022, this represented an increase of $3.6 million or 0.2%. The growth in the debt stock was mainly attributed to an expansion in the debt

held by Non-Central Government entities which grew by $12.0 million or 1.3%. Conversely, the debt held by the Central Government contracted by $8.5 million or 1.3%. The steadfast commitment to the sustainability of the country’s debt by the Ministry of Finance and the

continued implementation of Sustainable Island State Agenda has resulted in the downward trajectory of the debt to GDP ratio. As a result, we have once again achieved the Eastern Caribbean Central Bank’s debt target for its Eastern Caribbean Currency Union (ECCU) Members of 60% by 2035. St. Kitts and Nevis recorded a noteworthy reduction in its debt to GDP ratio from 60.2% in 2022 to the current level of 56.9%. It is anticipated that the debt to GDP ratio will decline even further to 56.6% by the end of 2023. It is remarkable for our Federation to achieve this milestone so soon after the devasting impact of the pandemic.

The Ministry of Finance is cognizant of its le1adership role in an environment where access to financing continues to be challenging and could greatly undermine the Sustainable Island State Agenda. The landscape in which the Citizenship by Investment Program operates has proven to be tenuous. Therefore, in 2023 the Ministry solicited the assistance of the International Monetary Fund (IMF) in undertaking a review of the tax regime within the Federation. Having received the draft report, we intend to complete this exercise in 2024. The Ministry of Finance will undertake further review and engagement on these critical areas to determine the most appropriate changes to the tax regime. This will also be guided by the need to safeguard and expand the revenue base while at the same time facilitating private investment and Private Sector development. The outcome of these assessments will inform the Government’s fiscal policy to strengthen the fiscal framework and

to safeguard our macroeconomic sustainability. The Ministry has remained a key stakeholder in the discussions regarding climate financing and the integration of the Multi-dimensional Vulnerability Index (MVI) all of which is critical to the advancement of our development agenda.

The Ministry’s Strategic Plan will continue to align with the Constitution, the Finance Administration Act, the Procurement and Contracts (Administration) Act, the Tax Administration and Procedures Act and other related policies and legislation of the Government. At this time, I would like to express my profound appreciation to the staff of the Ministry of Finance which include the Treasury Department, the Inland Revenue Department, the Customs and Excise Department and the Financial Intelligence Unit for their high level of professionalism and commitment to ensuring a strong foundation is maintained to support the transformational change to the lives and livelihoods of our

citizens and residents.

Hon Dr. Terrance M Drew

Minister of Finance

Prime Minister and Minister of Finance